“Freedom is an internal achievement rather than an external adjustment.” ~ Adam Clayton Powell

Our current environment exhibits an increase in government audits. There is also the profound burden of the ever changing rules and regulations from CMS. Insurance companies are being seen as a contender in the auditing arena. Improper payments are becoming more and more evident as the result of government audits. Is it because providers are doing something wrong?

The most common reasons for improper payments are the following:

- Payment is made for services that do not meet Medicare’s coverage and medical necessity criteria,

- Payment is made for services that are incorrectly coded, and

- Payment is made for services where the documentation submitted does not support the ordered service. ₁

In FY 2013, the Recovery Auditors identified and corrected $3.75 billion in improper payments. There were $3.65 billion collected in overpayments and $102.4 million in identified underpayments paid back to providers. After taking into consideration all costs to oversee the Recovery Audit Program, underpayment determinations that are paid to providers and appeal reversals, the Medicare FFS Recovery Audit Program returned $3.03 billion to the Medicare trust funds in FY 2013. ₁

Elizabeth Lamkin, a partner at PACE Healthcare Consulting said, “Only front-end compliance and documentation can prevent these takebacks. Each provider needs a coordinated and comprehensive approach to ensure that the financial and clinical departments are communicating to connect these dots.” ₂

Ensuring an internal auditing plan and taking control of your auditing process is vital to the sustainability of your financial stability. The importance of documentation quality management, policy and procedure compliance, internal auditing practices, and education and training is crucial to be free from resource and cost burdens of the appeal process. Compliance resource overhead is one department that generally does not seek enhancements; however, without a robust compliance department leading the pack, you are only setting your organization up for failure. Therefore, those companies who invest in an active Compliance Program will experience a decrease in financial risks when faced with government audits.

What does an internal auditing plan look like? This is a common question and the basic foundation is simple:

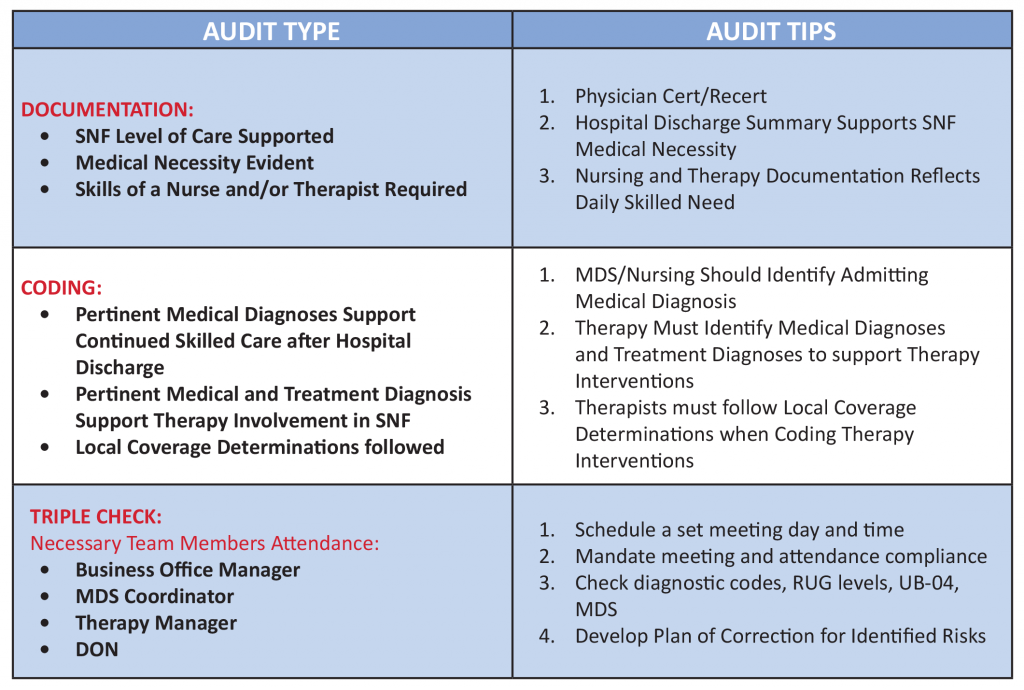

- Foster an environment of necessary internal auditing of documentation, coding, and billing compliance

- Establish and clearly define and assign the auditing process

- Mandate internal compliance with a triple check process

- Develop, implement, and track corrective action

- Develop an internal denial team

- Educate and train constantly

Nancy Beckley of Nancy Beckley and Associates blogged on July 31, 2014, “Have a monitoring and auditing program in place to ensure that you are routinely examining items that can prevent an infraction (monitoring) and an auditing program to ensure that you are examining compliance with documentation, billing and coding rules and other associated risks based upon healthcare statutes and guidance. For therapy providers a good audit place to start is documentation technical compliance as well as medical necessity and coding compliance.” 3

THE FINALE

Internal auditing is overhead, burdensome, and boring. Be creative when establishing an effective internal auditing program. Look at ways to score your internal audits in order to identify trends of improvement and continued problem areas. Identify your top five deficit areas and begin auditing those topics- do not make more work for yourself and reinvent the wheel!

THE SIGNPOSTS

If you are not auditing, how do you know what your deficits are and what your areas are in need of improvement? Are you auditing your records? If you are not actively auditing, you will be overwhelmed with the results of

external audits.

THE TAKEAWAY

Coming face-to-face with a government audit is inevitable. Regardless if you are an outlier or not, at one point in time, you will be audited. Ensuring your team is proactive and diligent in their auditing practices will decrease labor and cost burden should claims be denied. Working together as a team is the only way to ensure you are free from the overburden of managing denied claims.

VALUE IN INNOVATION

We are devoted to meeting the needs of our clients, our residents, and our employees. This devotion is necessary in order to move forward through today’s scrutiny. We must use our creativity and individualization to be worry-free when a government audit is upon us.

BE PROACTIVE! NOT REACTIVE!

₁ http://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Downloads/FY-2013-Report-To-Congress.pdf;

₂ http://www.healthleadersmedia.com/page-3/FIN-269064/CMS-IDs-Improper-Payments-Top-Regional-RAC-Issues##;

3 http://nancybeckley.com/top-3-essential-compliance-components/

Click here to download/print this Executive Brief:

Comments (0)