Saving more for retirement may not top your to-do list these days. The problem is most people need to save more, often a lot more, to build a nest egg that can meet their needs. Here’s a relatively painless way to help reach your goal.

Take small steps

Many financial experts recommend that you put away 10% to 15% of your pay for retirement. Begin by contributing a small amount, then consider gradually raising your contribution amount to 10% or higher. Getting your savings rate to where it needs to be can seem like a giant, expensive leap from where you stand. So, consider raising your plan contributions once a year by an amount that’s easy to handle, on a date that’s easy to remember, say,2% on your birthday.

A little more can mean a lot

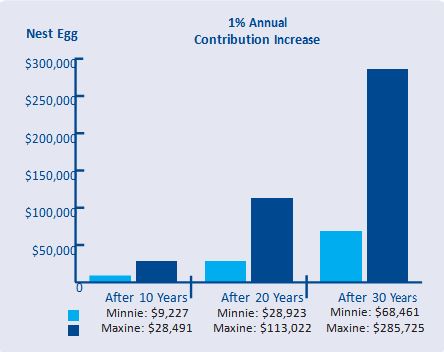

How big? Let’s look at Minnie and Maxine. These hypothetical twin sisters do almost everything together. Both work for the same company, earn the same salary($30,000 a year), and Minnie contributes 2% of her pay each year. Her salary rises 3% a year (her contributions along with it), and her investments earn 6% a year on average. So, after 30 years Minnie reaches retirement with a nest egg worth $68,461.

Participation the same retirement plan at age 35.

Maxine gets the same pay raises, saves just as diligently, and has the same investments as her sister, except for one thing. Maxine starts contributing 2%, but raises her rate by 1% each year on her birthday until she reaches 10%. Then she keeps saving that 10% for the next 22 years, until she retires by Minnie’s side.

The sisters celebrate at their favorite lunch spot, where Maxine tells Minnie that she never really noticed the difference in take-home pay when her savings rate was rising. Instead, all she saw was the result: $285,725 in her retirement fund by age 65.

Think ahead. Take action now.

- Aim for a 10% savings rate.

- Get on the escalator! Commit to modest but regular increases in your contribution rate.

This example is hypothetical and does not represent the performance of any fund.

Comments (0)